You are here

Home ›Mortgage Insurance (MI)

Lenders Mortgage Insurance (LMI), Private Mortgage Insurance (PMI). Insurance policy payable to a lender as an offset to losses incurred through a mortgagor’s default on a loan and the inability to recover costs after proceeds from a foreclosure auction. Typically required on mortgages in which a down payment is less than 20 percent of the sale price or appraised value of real property.

Starting a foreclosure is as easy as

- Click on the "Get Started Now" button below.

- Complete the secure online form, or download a printable version.

- Submit the form securely via the website, e-mail, fax, or mail it to us.

How do you decide what the “Opening Bid” is at the Trustee Sale?

Generally the opening bid is the amount of the principal, interest, late charges and any other advances made by the lender, including our trustee fees and costs. A lender can opt to reduce their opening bid as it may have some advantages. All strategies in this regard should be planned with the advice of your tax preparer and legal counsel.

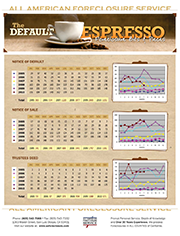

2009 To 2014 Foreclosure Statistics for San Luis Obispo County, California

This document details the number of Notice of Defaults, Notice of Sales, and Trustee's Deeds filed in San Luis Obispo County, CA from January 2009 through 2014. For review of data prior to 2009 please contact our office.