You are here

Home ›Non-Judicial Foreclosure

The foreclosure of real property, processed without court supervision or action filing. As mandated by state legislation, the procedure involves notification to interested parties (by personal service and/or publications and postings) and the final sale of the property at auction. Unless petitioned by the mortgagor, the court provides no supervision of the process, however, non-judicial foreclosures can be accompanied by further civil actions (including deficiency proceedings) involving the court. Non-judicial foreclosures are supported by a Deed of Trust or a Power of Sale clause in mortgage contracts.

Starting a foreclosure is as easy as

- Click on the "Get Started Now" button below.

- Complete the secure online form, or download a printable version.

- Submit the form securely via the website, e-mail, fax, or mail it to us.

What if the Borrower (Trustor) offers to make a partial payment?

Accepting a partial payment can jeopardize the validity of the foreclosure. You can accept a partial payment and rescind the foreclosure; however, you would need to record a new Notice of Default if they remain in default. You can accept money with a forbearance agreement. There are many ramifications of a forbearance agreement; the process should be guided by legal counsel.

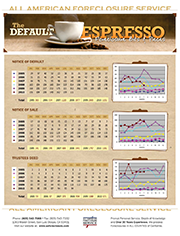

2009 To 2014 Foreclosure Statistics for San Luis Obispo County, California

This document details the number of Notice of Defaults, Notice of Sales, and Trustee's Deeds filed in San Luis Obispo County, CA from January 2009 through 2014. For review of data prior to 2009 please contact our office.