You are here

Home ›Non-Recourse Loan

Loan agreements in which the lender has no legal right to collect the "deficiency" from the borrower following the sale of a property at auction. The lender can only use the proceeds from the sale of the collateral (property), which secured the loan in default, to satisfy the debt. Regardless of the difference between the debt owed and the money recovered from the sale, the borrower is not held liable.

Starting a foreclosure is as easy as

- Click on the "Get Started Now" button below.

- Complete the secure online form, or download a printable version.

- Submit the form securely via the website, e-mail, fax, or mail it to us.

What we do during the "Reinstatement Period"?

All American Foreclosure Service will review and forward a copy of the Trustee Sale Guaranty we order from the Title Company, to see who has a recorded interest in the property as owner or as lien holder; check for bankruptcy and ensure proper notice to the Trustor and subsequent owners or junior lien holders. Within 10 days we are required to mail a copy of the Notice of Default to the Trustor and those who have recorded a Request for Special Notice and within 30 days we send a copy of the Notice of Default to any junior lien holders and other parties. Upon expiration of the 3 month reinstatement period, we proceed to set a Trustee Sale.

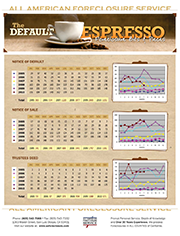

2009 To 2014 Foreclosure Statistics for San Luis Obispo County, California

This document details the number of Notice of Defaults, Notice of Sales, and Trustee's Deeds filed in San Luis Obispo County, CA from January 2009 through 2014. For review of data prior to 2009 please contact our office.