You are here

Home ›Foreclosure Process/Timeline

- Foreclosure Process Click an item to display full details

-

Close

Record Notice of Default

Record Notice of Default

Day 1

Foreclosure proceedings are initiated by recording a Notice of Default (NOD) in the county in which the property is located. This recording of the Notice of Default gives "Constructive Notice" to the public.

-

Close

First Mailing of Notice of Default

First Mailing of Notice of Default

Within 10 Days

The Notice of Default is mailed within 10 days of its recordation to the trustor at their last known physical address and to any persons who have recorded requests for notice.

-

Close

Second Mailing of Notice of Default

Second Mailing of Notice of Default

Within 1 Month

The Notice of Default is mailed to anyone holding an interest of record in the property that would be affected by the foreclosure; including successor owners, contract purchasers, junior lienholders, and various assignees.

-

Close

Set Sale Date

Set Sale Date

After 3 Months

If after 3 months the borrower has not remitted the arrearages, the lender will authorize and instruct the trustee to set a sale date.

-

Close

Record Notice of Sale

Record Notice of Sale

20 Days Before Sale

The Notice of Trustee Sale is recorded in the county in which the property is located. The recorded Notice of Sale is considered constructive notice and will include the date, time and location of the foreclosure sale.

-

Close

Publish, Post & Mail Notice of Sale

Publish, Post & Mail Notice of Sale

20 Days Before Sale Date

Publication - The Notice of Sale is published in an adjudicated newspaper once a week for 3 consecutive calendar weeks with the first publication to occur at least 20 days prior to the date.

Posting - The Notice of Sale must be posted on the property and in a public place in the appropriate city or judicial district of sale.

Mailing - The Notice of Sale is mailed to the property address and to all parties holding an interest of record in the property who would be affected by the foreclosure.

-

Close

Send Notice of Sale to IRS

Send Notice of Sale to IRS

25 Days Before Sale

Federal tax liens recorded more than 30 days before the date of the trustee sale are not extinguished by the sale unless the IRS was given notice at least 25 days before the date of the sale.

-

Close

Request for Directions Sent to Beneficiary

Request for Directions Sent to Beneficiary

Within 10 Days From 1st Publication of Notice of Sale

If the property does not have a common address any interested party may submit a written request for directions to the trustee.

-

Close

Bankruptcy Court Order

Bankruptcy Court Order

14 Days Before Sale

Trustee cannot hold the sale until 14 days after expiration of court order. If Trustor has filed a bankruptcy petition, an order granting a motion for relief from the automatic stay in accordance with Rule 4001(a)(1) is stayed until the expiration of 14 days after the entry of the order, unless the court orders otherwise.

-

Close

Right of Borrower to Reinstate Ends

Right of Borrower to Reinstate Ends

5 Days Before Sale

The borrower may reinstate the debt until 5 business days prior to the sale date. If the loan is not reinstated before 5 business days prior to the sale, the lender has the option to call the entire loan due.

-

Close

Sold at Trustee's Sale

Sold At Trustee's Sale

Sale

DateAfter the sale auction is completed and if the property sells to an outside third party bidder, all funds owed to the lender/beneficiary will be prepared for immediate payout. If the property reverts to the lender/beneficiary at the sale, a Trustee's Deed Upon Sale will be issued and the lender will have ownership to the property that was secured by the debt.

-

Notice of Default / Reinstatement Period

Foreclosure proceedings are initiated by recording a Notice of Default (NOD) in the county in which the property is located. This recording of the Notice of Default gives "Constructive Notice" to the public.

After the recording of the Notice of Default, in the state of California, the borrower and junior lien holders are given proper notification and the borrower has 3 months to bring their account current. This period is referred to as the Reinstatement Period. Many foreclosure proceedings are reinstated during this 3-month default period. The borrower or anyone with a subsequent interest in the property may pay the beneficiary or his authorized agent the amount necessary to cure the default.

This amount will include delinquent payments, and advances and the fees and costs associated with filing the notice of default and other necessary documents. When the default is cured, a Notice of Rescission will be prepared so that it can be signed by the beneficiary. When the Notice of Rescission is recorded it cancels the Notice of Default.

-

Notice of Trustees Sale

If after 3 months the borrower has not remitted the arrearages, the lender may authorize and instruct the Trustee to record the Notice of Trustee Sale (NOS).

The Notice of Trustee's Sale is recorded at the County Recorder's office in the County where the property is located. It contains the date, time and place where the auction will take place. This notice has to be published in an adjudicated newspaper in the county where the property is located. The NOS is also posted on the property as a requirement of law.

After 21 days of the recording of the NOS, a foreclosure sale can take place at public auction. The property may be sold to a third party bidder or revert back to the lender for a specified amount.

Bidders are required to bring cashier's checks or money orders to the sale in an amount equal to or higher than the lender's opening bid. The auctioneer will qualify each bidder and the successful bidder will have to tender full payment at the sale.

-

Disbursement of Funds

After the sale auction is completed and if the property sells to an outside third party bidder, all funds owed to the lender/beneficiary will be prepared for immediate payout. If the property reverts to the lender/beneficiary at the sale, a Trustee's Deed Upon Sale will be issued and the lender will have ownership to the property that was secured by the debt.

Starting a foreclosure is as easy as

- Click on the "Get Started Now" button below.

- Complete the secure online form, or download a printable version.

- Submit the form securely via the website, e-mail, fax, or mail it to us.

What if there are no bidders at the sale?

The property is then returned to the beneficiary. The beneficiary or lender now owns the property and they will receive a Trustee’s Deed within a few days. Their next step would be to make any preparations for taking possession of the property and plans for its disposition or liquidation.

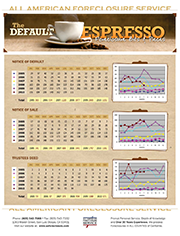

2009 To 2014 Foreclosure Statistics for San Luis Obispo County, California

This document details the number of Notice of Defaults, Notice of Sales, and Trustee's Deeds filed in San Luis Obispo County, CA from January 2009 through 2014. For review of data prior to 2009 please contact our office.