You are here

Home ›Good-Faith Estimate

A standard form provided by a mortgage lender or broker, as required by the Real Estate Settlement Procedures Act (RESPA), disclosing the estimated and itemized amount of fees and associated costs likely to be incurred in connection with a mortgage transaction including: closing costs, inspections, title insurance, taxes and other charges. Used to compare lender or broker quotes, this form must be provided within three business days of applying for a loan.

Starting a foreclosure is as easy as

- Click on the "Get Started Now" button below.

- Complete the secure online form, or download a printable version.

- Submit the form securely via the website, e-mail, fax, or mail it to us.

How long does a foreclosure take?

3 months plus 21 days. Please check out our Foreclosure Process/Timeline page for more information.

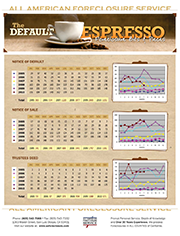

2009 To 2014 Foreclosure Statistics for San Luis Obispo County, California

This document details the number of Notice of Defaults, Notice of Sales, and Trustee's Deeds filed in San Luis Obispo County, CA from January 2009 through 2014. For review of data prior to 2009 please contact our office.