You are here

Home ›Mutual Agreement

The most common foreclosure postponement reason; it simply indicates that the homeowner and the lender have agreed to postpone the sale. This may be the result of a phone call where the homeowner has requested a little more time, or a more formal agreement like forbearance. Many homeowners do not realize when they enter a forbearance agreement that the foreclosure process continues and if they miss an agreed upon payment the property can be sold on the next scheduled sale date with no further notice.

Starting a foreclosure is as easy as

- Click on the "Get Started Now" button below.

- Complete the secure online form, or download a printable version.

- Submit the form securely via the website, e-mail, fax, or mail it to us.

What happens at the sale?

We announce the opening bid and ask the bidders to qualify by identifying themselves and showing the Auctioneer their cash and/or cashier’s checks in an amount sufficient to bid. All American Foreclosure Service conducts the sale and the successful bid is the highest bid over the opening bid. If there are other bidders, the highest bidder gains ownership of the property. We then accept money, obtain personal information and give the successful bidder a receipt. The Trustee’s Deed Upon Sale is prepared and delivered to them by the Trustee within a few days of the sale. The lender receives their money and an accounting as well.

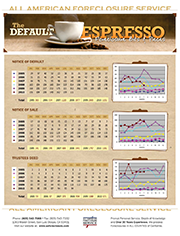

2009 To 2014 Foreclosure Statistics for San Luis Obispo County, California

This document details the number of Notice of Defaults, Notice of Sales, and Trustee's Deeds filed in San Luis Obispo County, CA from January 2009 through 2014. For review of data prior to 2009 please contact our office.