You are here

Home ›Real Estate Settlement Procedures Act (RESPA)

A U.S. Housing and Urban Development (HUD) consumer protection statute, designed to assist consumers in shopping for the lowest cost mortgages and to avoid costly or harmful loan offers, requiring that lenders and mortgage brokers provide standard disclosures at various times in a transaction and outlawing kickbacks that increase the cost of settlement services. Standard ╥good faith estimates╙ provided by a mortgage lenders or brokers disclose the estimated and itemized amount of fees and associated costs likely to be incurred in connection with a mortgage transaction including: closing costs, inspections, title insurance, taxes and other charges; this estimate must be provided within three business days of applying for a loan.

Starting a foreclosure is as easy as

- Click on the "Get Started Now" button below.

- Complete the secure online form, or download a printable version.

- Submit the form securely via the website, e-mail, fax, or mail it to us.

If someone is in the property after I become owner how do I get them out?

You should consult an attorney; however you can ask them, offer them money or sue them for "Unlawful Detainer", an eviction action. Your legal counsel can advise as to cost and time frames.

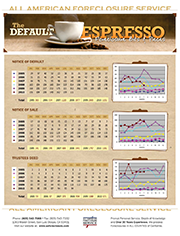

2009 To 2014 Foreclosure Statistics for San Luis Obispo County, California

This document details the number of Notice of Defaults, Notice of Sales, and Trustee's Deeds filed in San Luis Obispo County, CA from January 2009 through 2014. For review of data prior to 2009 please contact our office.