You are here

Home ›What if the Borrower (Trustor) calls us to pay off or bring the loan current?

You should direct all of their calls to our office for the exact amount of payoff or reinstatement. We forward this payoff to you for your review and approval. You should not accept any money from the Trustor once the foreclosure is started. In accepting money directly, you run the risk of invalidating the foreclosure and you may have to start the process over by recording a new Notice of Default and waiting out the three month reinstatement period.

Starting a foreclosure is as easy as

- Click on the "Get Started Now" button below.

- Complete the secure online form, or download a printable version.

- Submit the form securely via the website, e-mail, fax, or mail it to us.

What is the "Reinstatement Period"?

The 3 month period after the recording of the Notice of Default. This acts as a grace period, during which the Trustor/Borrower may cure the default by belated performance, if the default is curable. Please check out our Foreclosure Process Timeline page for more information.

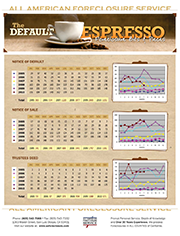

2009 To 2014 Foreclosure Statistics for San Luis Obispo County, California

This document details the number of Notice of Defaults, Notice of Sales, and Trustee's Deeds filed in San Luis Obispo County, CA from January 2009 through 2014. For review of data prior to 2009 please contact our office.